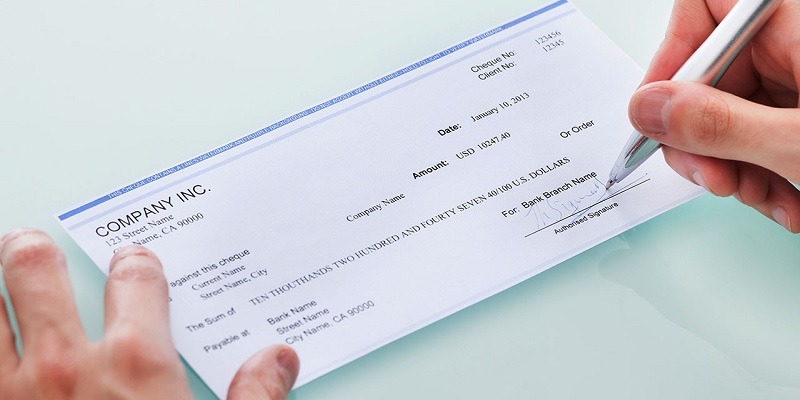

If you are looking for a sample of a cashier check, you have come to the right place. There are many different reasons why you might need to write one. For instance, if you work as a cashier for an establishment, you might need to pay the owner of the business. Also, if you’re running a fundraiser for charity, you might need to make a cashier’s check to collect the money. Using a cashier’s check can be easy, but it is important to remember that you should only get one from a financial institution that guarantees the amount you are paying.

Payee’s name

The cashier check sample is a simple piece of paper with a small amount of information on it. However, the teller will need to know more than what is on the page in order to cash the check. This is where the payee’s name comes in.

The payee’s name is the front and center of the paper. Typically, the bank will fill out the form for you. However, it is a good idea to know what’s on the page in case the teller does not. If the bank is unfamiliar with your account, they may not be able to fill out the payee’s name for you.

The payee’s name may be one of the more important elements of a check, but it is not the only piece of information you should keep in mind. One of the other most important pieces of information is the amount of money that is being paid. A smaller check will likely qualify for an exception.

Amount to be paid

A cashier’s check is a form of payment that can only be cashed by the designated payee. It is used in instances where secure forms of payment are not available. Cashier’s checks are also used as security deposits.

While there are many advantages to using cashier’s checks, there are also some disadvantages. For example, if you write a check for an amount that exceeds the limit of your bank account, you may be charged a fee. Also, a cashier’s check will not reverse itself if it is sent to someone else. However, if you find yourself with a check that you can’t use, you can cancel it for a small fee.

A cashier’s check may not be a good choice for your next big purchase. This is because you have to give the bank the full amount of the check before they can release it to the payee.

Guaranteed by the financial institution

A bank guarantee is a legal contract between a lending institution and a borrower, stating that the financial institution will indemnify the borrower from loss in the event the loan is not repaid in full. This type of security can be used in many ways. For example, it can be used as collateral in a rental agreement. It is also used to purchase goods or equipment.

There are two types of guarantees: direct and indirect. Direct guarantees are issued directly to the beneficiary and are typically used in international transactions. Indirect guarantees are required to be issued to a second bank, who then acts as the guarantor. Depending on the jurisdiction, guarantees may be unlimited or limited in amount. The implied upper limit of a guarantee’s amount depends on the total credit exposure of the borrower.

Indirect guarantees are most commonly used in the export business. Public entities such as governments are often the beneficiaries of this type of guarantee.

Scams involving cashier’s checks

Cashier’s checks are used by many businesses to transfer large sums of money. This type of check can also be used in a variety of scams. In fact, it is a popular fraud method.

In this type of scam, a thief contacts a consumer who makes a purchase online and asks them to send some of their cash to a third party. They will receive an item or goods in exchange. After the recipient receives the items, they may find that the cashier’s check was fake.

The scam involves sending a check in an amount above the cost of the goods. These checks can be issued to people in a foreign country, and the person will be expected to deposit it and pay the bank the appropriate amount. However, if the check is fraudulent, the victim will lose their money.

Scammers also use these types of checks to entice consumers to buy goods in advance. Often, they tell the victims that the check is for taxes, fees, or other arbitrary reasons.

I agree with your point of view, your article has given me a lot of help and benefited me a lot. Thanks. Hope you continue to write such excellent articles.

Reading your article helped me a lot and I agree with you. But I still have some doubts, can you clarify for me? I’ll keep an eye out for your answers.

I have read your article carefully and I agree with you very much. So, do you allow me to do this? I want to share your article link to my website: Log in

I have read your article carefully and I agree with you very much. This has provided a great help for my thesis writing, and I will seriously improve it. However, I don’t know much about a certain place. Can you help me?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/uk-UA/register?ref=W0BCQMF1

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.com/en/register?ref=PORL8W0Z

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/pt-BR/register?ref=B4EPR6J0

Can you be more specific about the content of your enticle? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.com/en/register?ref=P9L9FQKY

Your article gave me a lot of inspiration, I hope you can explain your point of view in more detail, because I have some doubts, thank you.

Your article gave me a lot of inspiration, I hope you can explain your point of view in more detail, because I have some doubts, thank you.

Thank you very much for sharing, I learned a lot from your article. Very cool. Thanks. nimabi

Thank you very much for sharing, I learned a lot from your article. Very cool. Thanks. nimabi

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.com/uk-UA/register-person?ref=T7KCZASX

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/sl/join?ref=UM6SMJM3

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!